Internal Controls and Its Scope

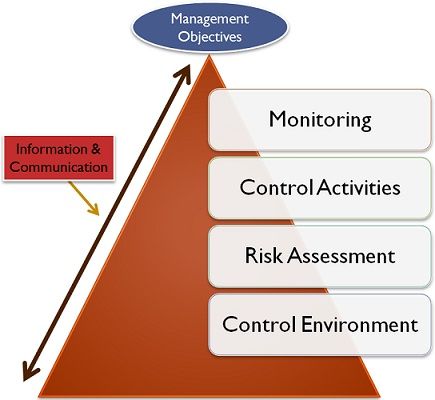

Internal controls

Are certain checks and procedures, installed by the management, to prevent financial fraud or misappropriation of assets. In other words, the internal control system can be defined to be the policies, practices, procedures, and tools designed with the objective to:

(1) safeguard corporate assets,

(2) ensure the accuracy and reliability of data captured and information products,

(3) promote efficiency,

(4) measure compliance with corporate policies,

(5) measure compliance with regulations, and

(6) manage the negative events and effects from fraud, crime, and deleterious activities

Scope of Internal Control

Internal control is an essential pre-requisite for efficient and effective management of any organization and is, therefore, a fundamental ingredient for the successful operation of the business in modern days. In fact, an effective internal control system is a critical success factor for any organization in the long term. Scope of internal auditors/area of operations of internal audit are as under:-

1. Reliability and integrity of financial and operating information: Internal auditors should review the reliability and integrity of financial and operating information and the means used to identify, measure, classify, and report such information.

2. Compliance with laws, policies, plans, procedures, and regulations: Internal auditor should review the systems established to ensure compliance with those policies, plan and procedures, law, and regulations which could have a significant impact on operations and reports and should determine whether the organization is in compliance thereof.

3. Safeguarding of Assets: Internal auditors should verify the existence of assets and should review the means of safeguarding assets.

4. Economic and efficient use of resources: Internal auditor should ensure the economic and efficient use of resources available

5. Accomplishing of established objectives and goals for operations: Internal auditor should review operation or programmes to ascertain whether results are consistent with established objectives and goals and whether the operations or programmes are being carried out as planned.

Buy Cost Audit Classes:

.jpg)

Top Reviews

Introduction to Statistics for CA Foundation

Introduction to Statistics for CA Foundation Business Mathematics, Logical Reasoning and Statistics is designed as per latest CA Foundation syllabus for Paper 3 to provide a firm grounding in the principles, techniques and practice. The book adopts self-study approach and has been written in student-friendly manner. With a blend of conceptual learning and problem-solving approach, it offers in-depth understanding of the basic mathematical and statistical tools. #introductiontostatistics

.jpg)

Chapter X of Companies Act 2013

Chapter X of Companies Act 2013 The company shall place the matter relating to such appointment for ratification by members at every annual general meeting. ... Under the Act, the provisions for rotation of auditors in the listed Company & certain other class of Companies, have been provided for. #chapterxofcompaniesact2013

.jpg)

Relevant sections under the Companies Act, 2013 dealing with fraud and false statements

Relevant sections under the Companies Act, 2013 dealing with fraud and false statements The new parent corporate law “The Companies Act 2013” is mostly ... I am limiting my write-up to the provisions to the Act, and I request the readers to refer relevant rules, if any, before ... in the 2013 Act is the Section 447 dealing with “Punishment for fraud”. ... Section 448

.jpg)

What is Corporate Image

What is Corporate Image A corporate identity or corporate image is the manner in which a corporation, firm or business enterprise presents itself to the public. The corporate identity is typically visualized by branding and with the use of trademarks, but it can also include things like product design, advertising, public relations etc #WhatisCorporateImage

.jpg)

What is Energy Audit

What is Energy Audit An energy audit is an inspection survey and an analysis of energy flows for energy conservation in a building. It may include a process or system to reduce the amount of energy input into the system without negatively affecting the output. #whatisenergyaudit

.png)

.png)

.png)

.png)

.png)