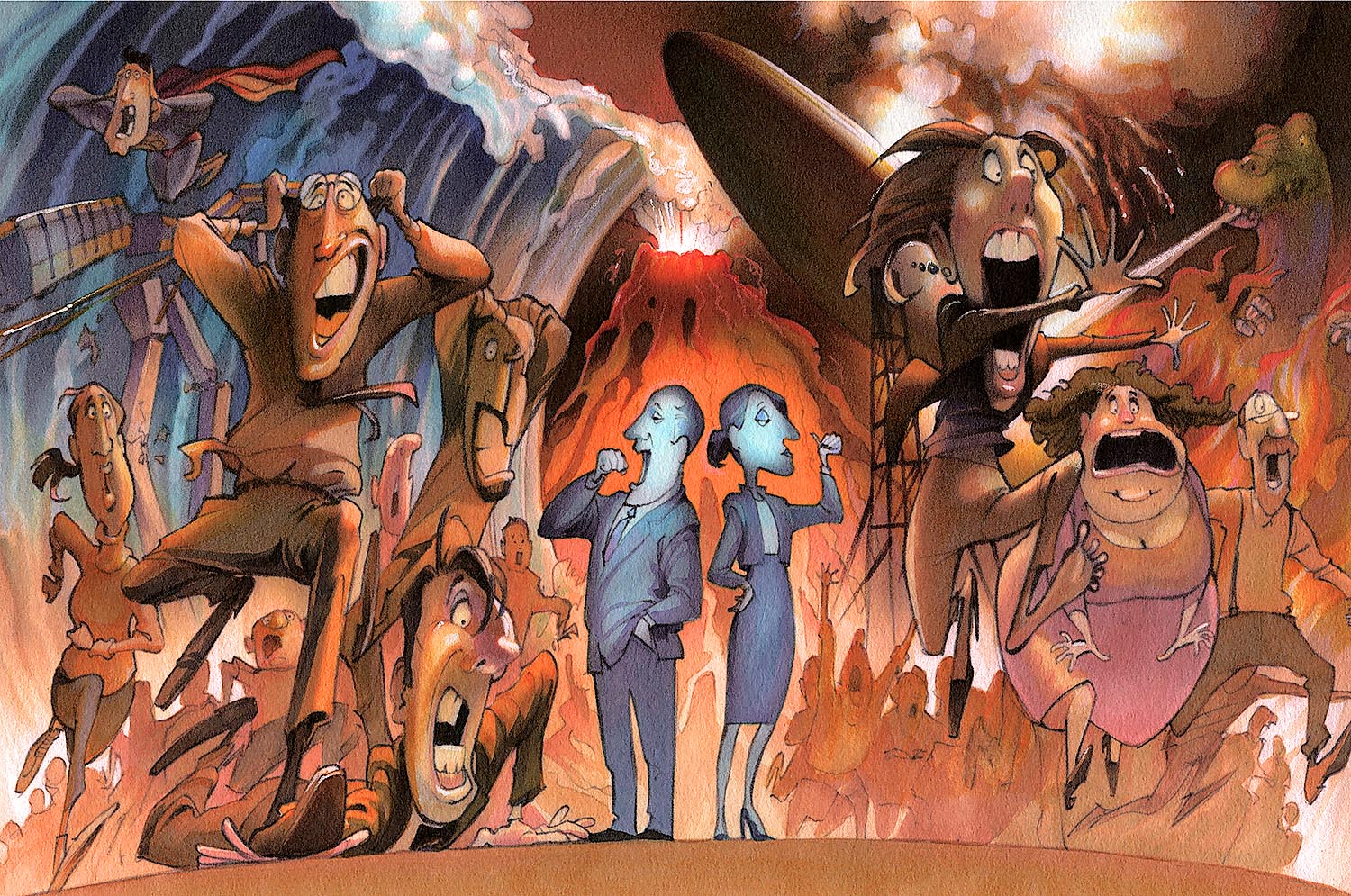

Corporate Distress Analysis

Corporate Distress Analysis - Causes

1. Technological Causes - If within an industry, there is a failure to upgrade to information technology and new production technology, the firms can face serious problems and ultimately fail. By using new technology, the cost of production can be reduced.

If an organization continues to use the old technology and its competitors start using the new technology; this can be detrimental to that organization. This situation was seen in the case of Mittal Steel Company taking over Arcelor Steel Company. Arcelor Steel Company was using its old technology to make steel while Mittal Steel Company was using the new technology and as a result, Mittal Steel Company was able to sell steel at a lower price than Arcelor Steel Company due to its low cost of production.

2. Working Capital Problems - Organizations also face liquidity problems when they are in financial distress. Poor liquidity becomes apparent through the changes in the working capital of the organization as they have insufficient short term funds to manage their daily expenses.

3. Economic Distress - A turndown in an economy can lead to corporate failures across a number of businesses. The level of activity will be reduced, thus affecting negatively the performance of firms in several industries. This cannot be avoided by businesses.

4. Mismanagement - Inadequate internal management control or lack of managerial skills and experience is the cause of the majority of company failures. Some managers may lack strategic capability that is to recognize strengths, weaknesses, opportunities, and threats of a given business environment. These managers tend to make poor decisions, which may have bad consequences afterward.

5. Over-expansion and Diversification - The situation of over-expansion may arise to the point that little focus is given to the core business and this can be harmful as the business may become fragment and unfocused. In addition, companies may not understand the new business field. In such cases, the managers are not able to understand how growing overcapacity would influence its investment and therefore did not comprehend the risks associated with it.

6. Fraud by Management - Management fraud is another factor responsible for the corporate collapse. Ambitious managers may be influenced by personal greed. They manipulate financial statements and accounting reports. Dishonest managers will attempt to tamper and falsifying business records in order to fool shareholders about the true financial situation of the company. These frauds can lead to serious consequences: loss of revenue, damage to the credibility of the company, increased operating expenses, and a decrease in operational efficiency.

7. Poorly Structured board - Board of Directors of the Company may lack the necessary competence and may not control business matters properly. These directors are often intimated by a dominant CEO and do not have any say in decision making.

Buy Classes:https://www.conceptonlineclasses.com/course/c-om-bo

#CorporateDistressAnalysis

.jpg)

Top Reviews

Introduction to Statistics for CA Foundation

Introduction to Statistics for CA Foundation Business Mathematics, Logical Reasoning and Statistics is designed as per latest CA Foundation syllabus for Paper 3 to provide a firm grounding in the principles, techniques and practice. The book adopts self-study approach and has been written in student-friendly manner. With a blend of conceptual learning and problem-solving approach, it offers in-depth understanding of the basic mathematical and statistical tools. #introductiontostatistics

.jpg)

Chapter X of Companies Act 2013

Chapter X of Companies Act 2013 The company shall place the matter relating to such appointment for ratification by members at every annual general meeting. ... Under the Act, the provisions for rotation of auditors in the listed Company & certain other class of Companies, have been provided for. #chapterxofcompaniesact2013

.jpg)

Relevant sections under the Companies Act, 2013 dealing with fraud and false statements

Relevant sections under the Companies Act, 2013 dealing with fraud and false statements The new parent corporate law “The Companies Act 2013” is mostly ... I am limiting my write-up to the provisions to the Act, and I request the readers to refer relevant rules, if any, before ... in the 2013 Act is the Section 447 dealing with “Punishment for fraud”. ... Section 448

.jpg)

What is Corporate Image

What is Corporate Image A corporate identity or corporate image is the manner in which a corporation, firm or business enterprise presents itself to the public. The corporate identity is typically visualized by branding and with the use of trademarks, but it can also include things like product design, advertising, public relations etc #WhatisCorporateImage

.jpg)

What is Energy Audit

What is Energy Audit An energy audit is an inspection survey and an analysis of energy flows for energy conservation in a building. It may include a process or system to reduce the amount of energy input into the system without negatively affecting the output. #whatisenergyaudit

.png)

.png)

.png)

.png)

.png)